Loans and shopping in one

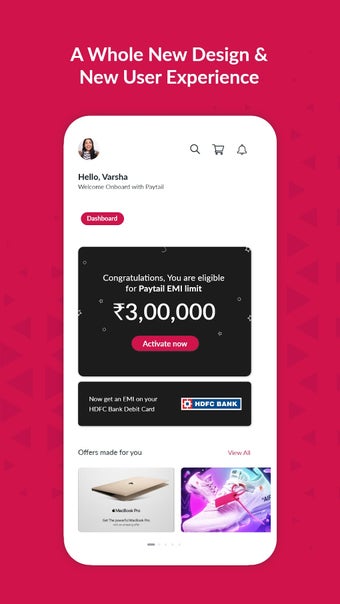

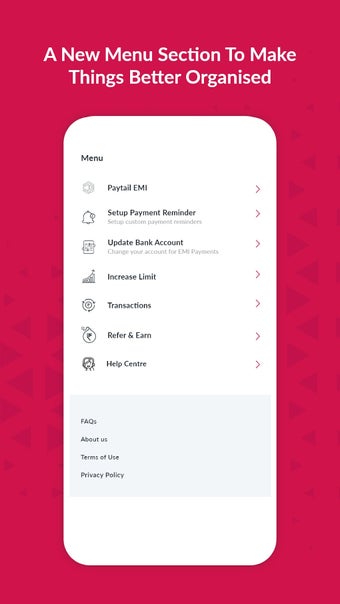

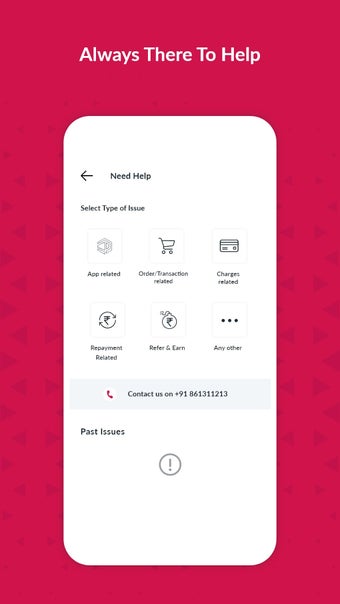

Paytail is a free finance and ecommerce platform in India that offers a convenient way to shop from various merchants and stores. One of its key features is the Paytail EMI option, which allows eligible users to avail of instant loans for their shopping needs.

Easy access to loans

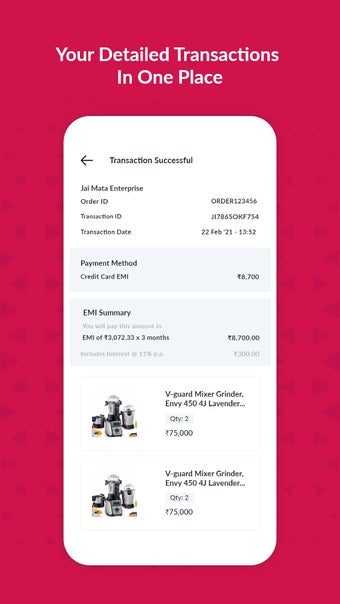

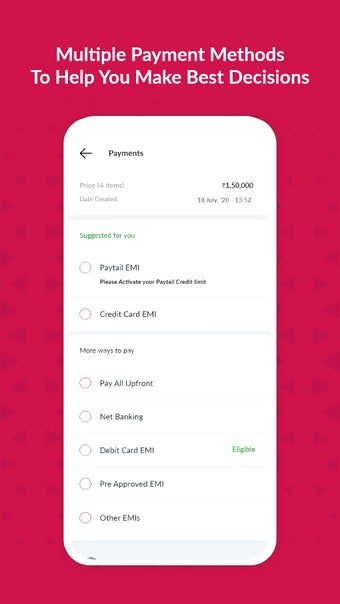

Paytail offers loan amounts from INR3,000 to INR5,00,000 and can be repaid from three to 18 months. The interest rate also varies, depending on your profile assessment. These loans can then be used as your credit limit to purchase from partner merchants, using the service as your mode of payment.

One catch, though—the interest rate starts at 18 percent per annum and can go up to 25 percent per annum based on your assessment, which can be hefty especially once it starts piling up. Still, it provides easy access to credit for users without a credible credit rating yet.

OK for starters

Paytail provides users with credit limits in the form of a loan for their purchases, making it a useful tool for those without established credit ratings. However, it's important to consider the interest rates, which can range from 18 to 25 percent p.a. based on the user's profile assessment.